Tradelink Electronic Commerce Limited

Interim Report 2017

40

Notes to the Unaudited Interim Financial Report

(Continued)

未經審核中期財務報告附註

(續)

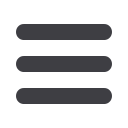

7 Taxation

Six months ended 30 June

六月三十日止六個月

2017

2016

二零一七年

二零一六年

HK$’000

HK$’000

港幣千元

港幣千元

Provision for Income Tax for the period

本期間的所得稅撥備

– Hong Kong Profits Tax

- 香港利得稅

5,124

5,071

– PRC tax

- 中國稅項

25

–

Deferred taxation

(Note 12)

遞延稅項

(附註

12

)

821

(11,891)

Income tax expense/(credit)

所得稅開支╱(抵免)

5,970

(6,820)

The provision for Hong Kong Profits Tax for the period is calculated at

16.5% (2016: 16.5%) of the estimated assessable profits for the period.

The provision for PRC tax for the period is calculated at applicable tax rate

of 25% in the PRC.

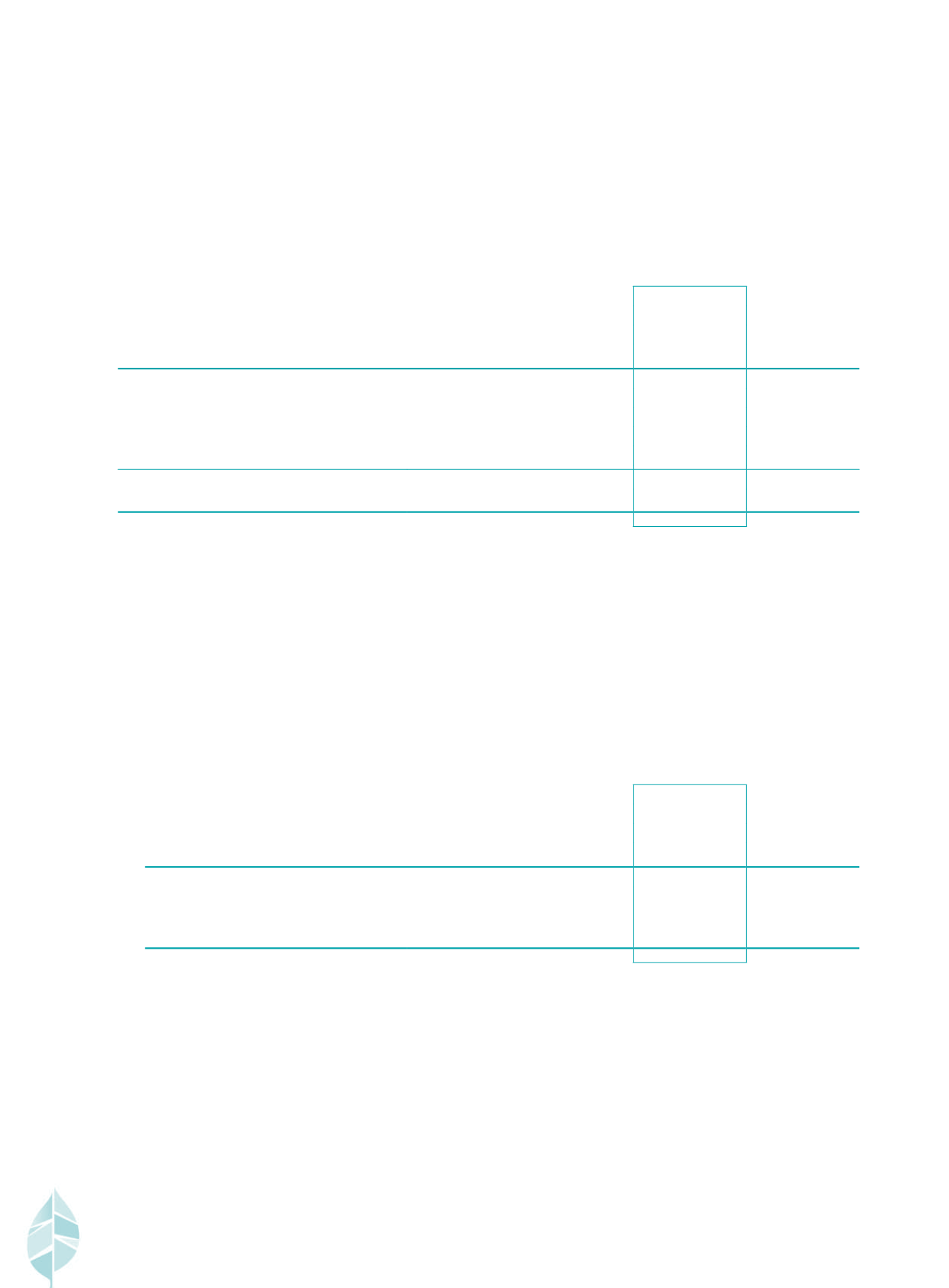

8 Dividends

(a) Dividends payable to equity shareholders of the Company

attributable to the interim period

Six months ended 30 June

六月三十日止六個月

2017

2016

二零一七年

二零一六年

HK$’000

HK$’000

港幣千元

港幣千元

Interim dividend declared after the interim

period of HK 3.2 cents per share

(2016: HK 2.4 cents per share)

於中期期間後宣派的中期股息

每股

3.2

港仙(二零一六年:

每股

2.4

港仙)

25,427

19,066

The interim dividend declared after the interim period has not been

recognised as a liability at the end of the reporting period.

7

稅項

於本期間,香港利得稅撥備乃按期內估計應課稅溢利

的

16.5%

(二零一六年:

16.5%

)計算。於本期間,中國

稅項撥備乃根據中國適用稅率按

25%

計算。

8

股息

(a)

中期期間應付本公司股權持有人的股息

於中期期間後宣派的中期股息未於報告期末確認

為負債。