Tradelink Electronic Commerce Limited

貿易通電子貿易有限公司

92

Notes to the Financial Statements

財務報表附註

8 Income tax in the consolidated statement of

financial position (continued)

(b) Deferred tax liabilities recognised: (continued)

In accordance with the accounting policy set out in

Note 1(o)

,

the Group has not recognised deferred tax assets in respect of

cumulative tax losses of HK$86,569,000 (2014: HK$94,653,000) as

it is not probable that future taxable profits against which the losses

can be utilised will be available. The tax losses do not expire under

current tax legislation.

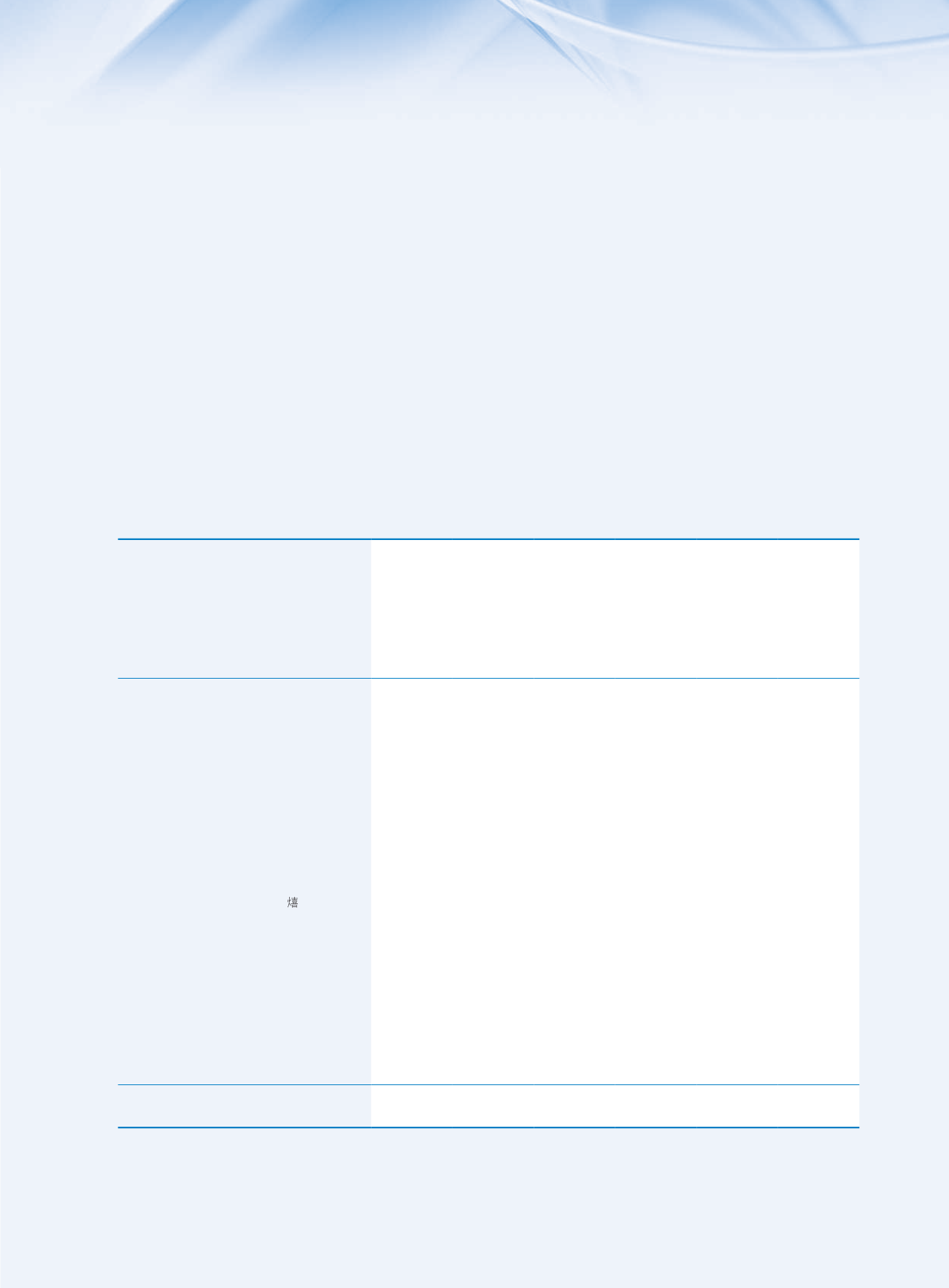

9 Directors’ and chief executive’s emoluments

Directors’ emoluments disclosed pursuant to section 383(1) of the Hong

Kong Companies Ordinance and Part 2 of the Companies (Disclosure of

Information about Benefits of Directors) Regulation is as follows:

Fees

Basic salary,

allowances and

other benefits

Contributions

to retirement

schemes

Bonus*

Share-based

payments

2015

Total

袍金

基本薪金、津貼

及其他福利 退休計劃供款

花紅

*

以股份為

基礎的支付

二零一五年

總計

HK$’000

HK$’000

HK$’000

HK$’000

HK$’000

HK$’000

港幣千元 港幣千元 港幣千元 港幣千元 港幣千元 港幣千元

Executive directors

執行董事

TSE Kam Keung

謝錦強

154

2,280

9

–

47

2,490

CHENG Chun Chung, Andrew

鄭俊聰

–

2,709

18

968

142

3,837

CHUNG Shun Kwan, Emily

鍾順群

–

2,164

18

299

71

2,552

LI Fuk Kuen, Wilfred

李福權

–

1,692

6

108

57

1,863

WU Wai Chung, Michael

(retired as executive director

on 8 May 2015)

吳偉驄(於二零一五年

五月八日退任

執行董事)

–

1,588

–

3,368

97

5,053

Non-executive directors

非執行董事

LEE Nai Shee, Harry

李乃

100

–

–

–

160

260

LEE Delman

李國本

70

–

–

–

47

117

CHAK Hubert

翟廸強

300

–

–

–

160

460

CHAN Chi Yan

陳紫茵

259

–

–

–

–

259

CHAU Tak Hay

周德熙

340

–

–

–

96

436

CHUNG Wai Kwok, Jimmy

鍾維國

360

–

–

–

144

504

HO Lap Kee, Sunny

何立基

310

–

–

–

160

470

KIHM Lutz Hans Michael

KIHM Lutz Hans

Michael

50

–

–

–

–

50

YING Tze Man, Kenneth

英子文

50

–

–

–

47

97

Total

總計

1,993

10,433

51

4,743

1,228

18,448

8

綜合財務狀況表的所得稅(續)

(b)

已確認的遞延稅項負債:(續)

根據

附註

1(o)

所載會計政策,本集團並無就

累計可抵扣稅項虧損確認遞延稅項資產港幣

86,569,000

元(二零一四年:港幣

94,653,000

元),原因為於未來不大可能取得應課稅溢利而令

該項資產得以運用。根據現行稅務條例,上述稅

項虧損不設應用限期。

9

董事及行政總裁酬金

根據香港《公司條例》第

383(1)

條及公司(披露董事利益

資料)規例第

2

部披露的董事酬金詳情如下: