44

Tradelink Electronic Commerce Limited

貿易通電子貿易有限公司

Notes to the Unaudited Interim Financial Report

(Continued)

未經審核中期財務報告附註

(續)

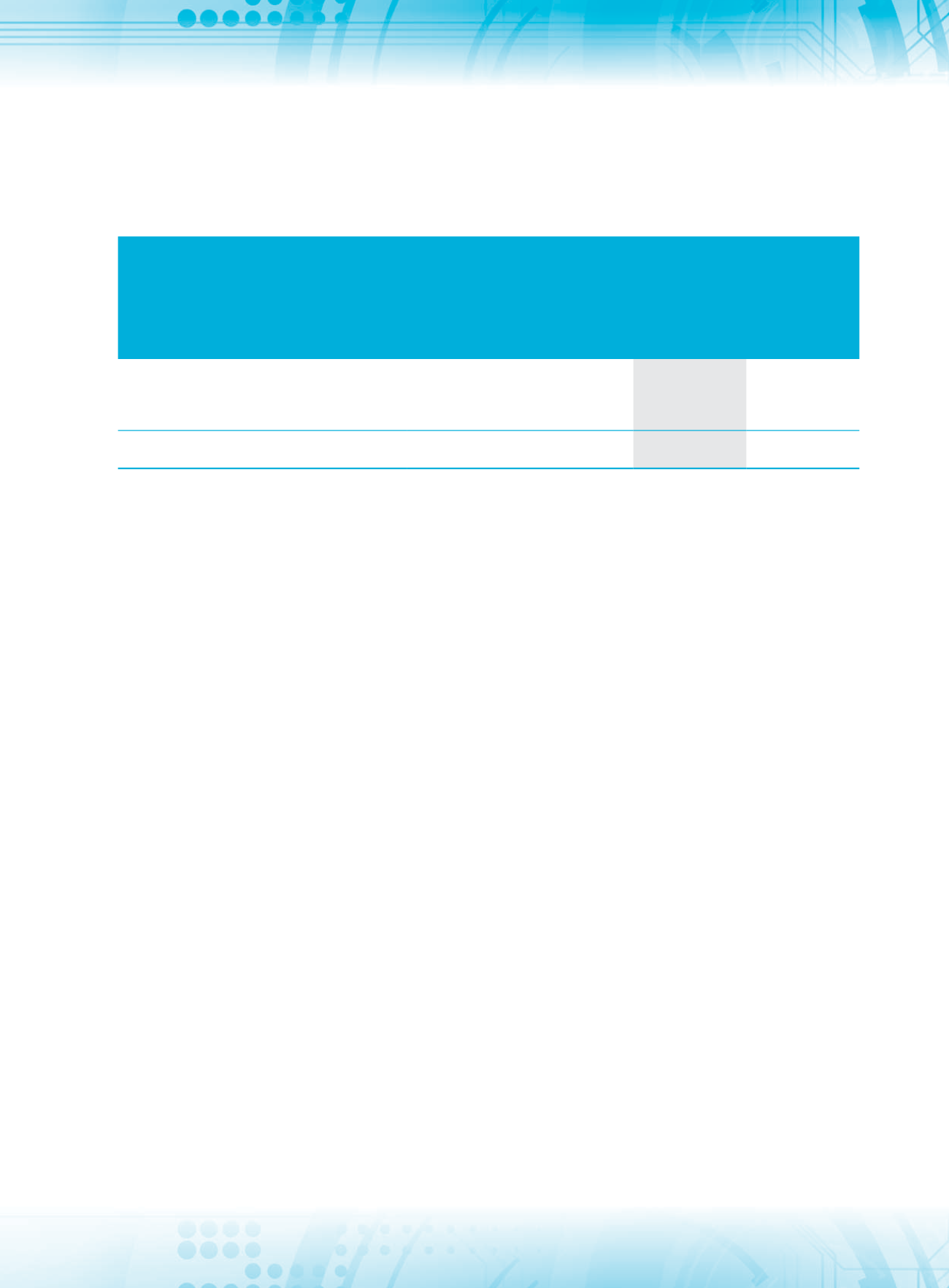

16

應付賬款、應付款項及其他應付款項

16 Trade creditors, accounts payable and other payables

As at

30 June

2015

As at

31 December

2014

於二零一五年

六月三十日

於二零一四年

十二月三十一日

HK$’000

HK$’000

港幣千元

港幣千元

Trade creditors

(Note 16(a))

應付賬款

(附註

16(a)

)

7,248

9,706

Customer deposits received

(Note 16(b))

已收客戶按金

(附註

16(b)

)

155,327

157,705

Accrued charges and other payables

(Note 16(c))

應計開支及其他應付款項

(附註

16(c)

)

73,647

59,214

236,222

226,625

(a) Trade creditors are due within 1 month or on demand.

(b) Deposits received are monies received from customers before they

are allowed to make trade transactions through the use of the Group’s

systems. Generally, customers are only allowed to incur transaction

charges up to the amount deposited with the Group. Deposits are

refundable to customers on demand.

(c) Included in the balance of accrued charges and other payables are

in the total amount of RMB20 million (equivalent to HK$24,752,000)

received during 2015 from potential buyers for the acquisition of the

Company’s stake of 25.17% in China International Data Systems Co.,

Ltd (“Guofurui”).

17 Equity-settled share-based transactions

(a) Share option schemes

The Company adopted a Pre-IPO share option scheme on 2 August

2000 which was amended on 11 September 2001 and 26

November 2002 respectively, and a Post-IPO share option scheme

on 14 October 2005, whereby the Directors of the Company are

authorised, at their discretion, to invite employees of the Group,

including Directors of any company in the Group, to take up options

at consideration of HK$1.00 per grant to subscribe for shares of the

Company. Each option gives the holder the right to subscribe for one

ordinary share in the Company. The terms and conditions of the share

option schemes are disclosed in the annual financial statements as at

and for the year ended 31 December 2014.

On 16 March 2009, the Share Option Schemes were discontinued

and replaced by the Share Award Scheme. Share options previously

granted under the Share Option Schemes remain valid and subject to

the same terms and conditions.

The Company adopted a Share Option Scheme 2014 on 9 May

2014, whereby options will be granted to eligible persons, including

Directors, employees, consultants, business associates or advisers as

the Board of the Company may identify from time to time (“Grantees”),

entitling them to subscribe for shares of the Company, subject to

acceptance of the Grantees and the payment of HK$1.00 by each of

the Grantees upon acceptance of the options. Each option gives the

holder the right to subscribe for one ordinary share in the Company.

(a)

應付賬款須於一個月內或按要求償還。

(b)

已收按金即客戶獲准使用本集團的系統進行貿易

交易前自客戶收到的款項。一般來說,客戶僅可

累積的交易費,以客戶向本集團支付的按金為

限。按金可應客戶要求予以退還。

(c)

在應計開支及其他應付款項結餘中,包括為收購

本公司所持國富瑞數據系統有限公司(「國富瑞」)

25.17%

的股權,於二零一五年自潛在買家收到

的款項總額人民幣

20,000,000

元(相當於港幣

24,752,000

元)。

17

以股權結算的股份交易

(a)

購股權計劃

本公司於二零零零年八月二日採納首次公開招股

前購股權計劃(分別於二零零一年九月十一日及

二零零二年十一月二十六日作出修訂),並於二零

零五年十月十四日採納首次公開招股後購股權計

劃。據此,本公司董事獲授酌情權,可邀請本集

團僱員(包括本集團旗下任何公司的董事)接納可

認購本公司股份的購股權,每名承授人於接納購

股權時須支付港幣

1.00

元。每份購股權賦予其持

有人權利,可認購一股本公司普通股。購股權計

劃的條款及條件,已於二零一四年十二月三十一

日及截至該日止年度結算的年度財務報表披露。

於二零零九年三月十六日,購股權計劃終止,並

由股份獎勵計劃所取代。先前根據購股權計劃授

出的購股權繼續有效,並須受相同條款及條件所

規限。

本公司於二零一四年五月九日採納二零一四年購

股權計劃,向本公司董事會不時確定之合資格人

士(包括董事、僱員、專業顧問、業務夥伴或諮詢

顧問)(「承授人」)授出購股權,賦予彼等權利認購

本公司股份,惟須待承授人接納方可作實,且每

名承授人於接納購股權時須支付港幣

1.00

元。每

份購股權賦予持有人權利認購一股本公司普通股。