Tradelink Electronic Commerce Limited

貿易通電子貿易有限公司

126

Notes to the Financial Statements

財務報表附註

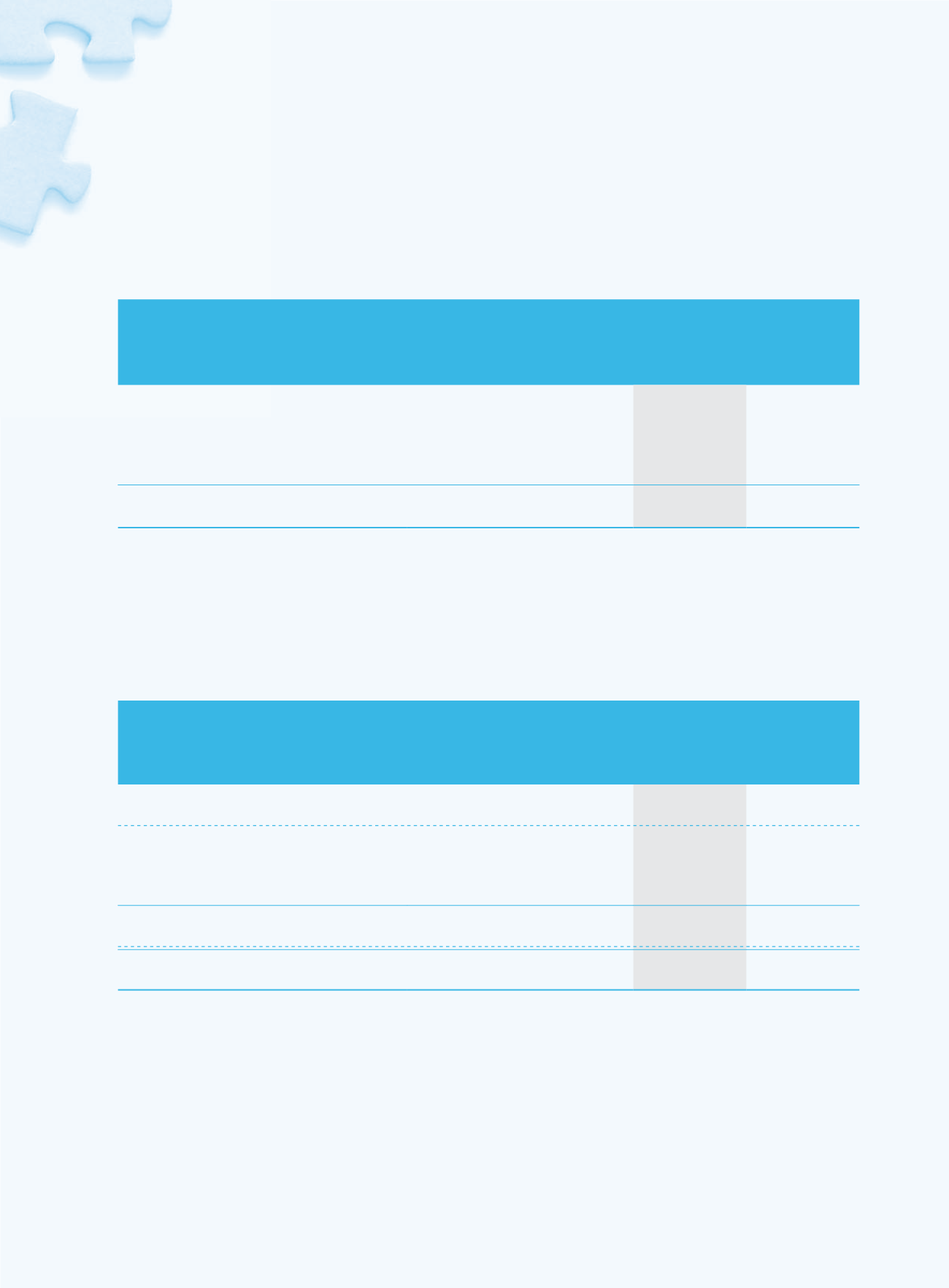

19 Trade receivables

As of the end of the reporting period, the ageing analysis of trade

receivables, based on the invoice date, is as follows:

2016

2015

二零一六年

二零一五年

HK$’000

HK$’000

港幣千元

港幣千元

Less than 1 month

少於一個月

17,463

15,729

1 to 3 months

一至三個月

6,137

2,510

3 to 12 months

三至十二個月

1,619

1,545

Over 12 months

超過十二個月

810

2,122

26,029

21,906

The Group’s credit policy is set out in

Note 26(a)

.

All the above balances are expected to be recovered within one year and

they are generally covered by deposits from customers (see

Note 21(ii)

).

The ageing analysis of trade receivables that are past due but neither

individually nor collectively considered as impaired are as follows:

2016

2015

二零一六年

二零一五年

HK$’000

HK$’000

港幣千元

港幣千元

Neither past due nor impaired

並無逾期亦無減值

14,912

13,522

Less than 1 month past due

逾期少於一個月

4,758

3,317

1 to 3 months past due

逾期一至三個月

4,434

2,520

Over 3 months past due

逾期超過三個月

1,925

2,547

11,117

8,384

26,029

21,906

Receivables that were neither past due nor impaired relate to a wide

range of customers for which there was no recent history of default.

Receivables that were past due but not impaired relate to a number of

independent customers that have a good track record with the Group.

Based on past experience, management considers that no impairment

allowance is necessary in respect of these balances as there has not been

a significant change in credit quality and the balances are still considered

fully recoverable.

19

應收賬款

於報告期末,按發票日期計算,應收賬款的賬齡分析

如下:

本集團的信貸政策載於

附註

26(a)

。

預期上述結餘均可於一年內收回,並一般得到客戶提

供的按金所保證(見

附註

21(ii)

)。

已逾期但並無個別或集體被視作出現減值的應收款項

的賬齡分析如下:

並無逾期亦無減值的應收款項與大量客戶有關,該等

客戶並無近期拖欠還款記錄。

已逾期惟並無出現減值的應收款項與多名獨立客戶有

關。該等客戶於本集團的過往信貸紀錄良好。根據過

往經驗,管理層認為,由於信貸質素並無重大變動,

且該等結餘仍被視作可全數收回,故毋須為該等結餘

計提減值撥備。