Annual Report 2016

二零一六年年報

133

Notes to the Financial Statements

財務報表附註

24 Equi t y - set t l ed share-based t ransact i ons

(continued)

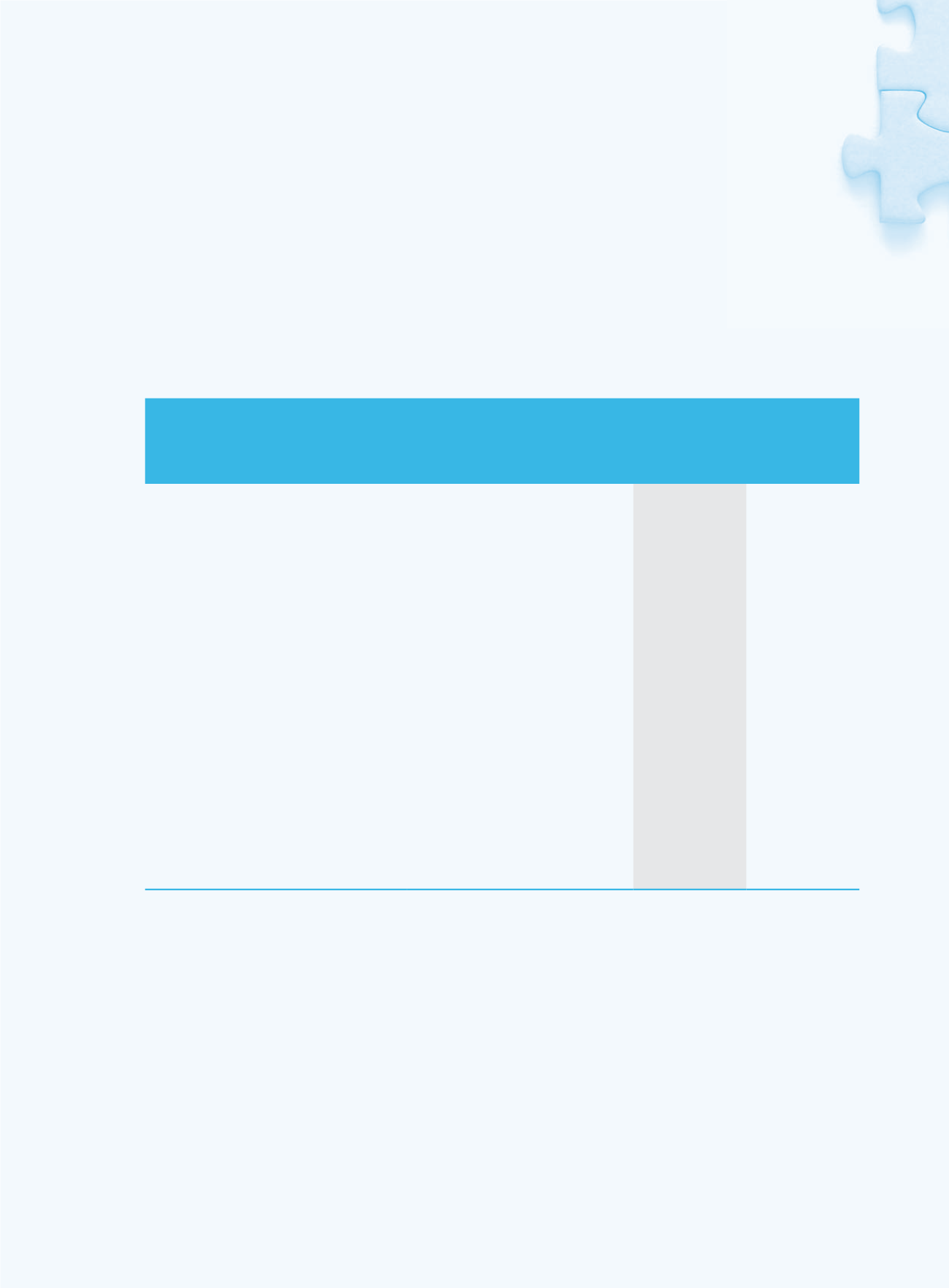

(b) Fair value of share options and assumptions

The fair value of services received in return for share options

granted is measured by reference to the fair value of share options

granted. The estimate of the fair value of the share options granted is

measured based on Black Scholes Model. The contractual life of the

share option is used as an input into this model.

2016

2015

二零一六年

二零一五年

HK$’000

HK$’000

港幣千元

港幣千元

Fair value of share options and assumption

購股權的公允價值及假設

HK$0.180

港幣

0.180

元

HK$0.191

港幣

0.191

元

Share price

股價

HK$1.57

港幣

1.57

元

HK$1.73

港幣

1.73

元

Exercise price

行使價

HK$1.57

港幣

1.57

元

HK$1.78

港幣

1.78

元

Expected volatility (expressed as weighed

average volatility used in the modelling

under Black Scholes Model)

預期波幅(按柏力克舒爾斯模式所用之

加權平均波幅呈列)

30.0%

30.0%

Option life

購股權有效期

5 years

5

年

5 years

5

年

Expected dividends

預期股息

6.7%

7.0%

Risk-free interest rate (based on the yield of

Hong Kong Government Bonds)

無風險利率(按香港政府債券

收益率計算)

0.589%

1.166%

The expected volatility is made with referenced to the daily historical

volatilities of the Company with period commensurate to the

expected option life. Expected dividends are based on historical

dividends. Changes in the subjective input assumptions could

materially affect the fair value estimate.

Share options were granted under a service condition. This

condition has not been taken into account in the grant date fair

value measurement of the services received. There were no market

conditions associated with the share option grants.

24

以股權結算並以股份為基礎的交易

(續)

(b)

購股權的公允價值及假設

作為授出購股權代價而獲得的服務公允價值,乃

參照已授出購股權的公允價值計算。已授出購股

權的估計公允價值乃根據柏力克舒爾斯模式計

算。此模式亦會計及購股權的合約年期。

預期波幅乃參考本公司過往與預期購股權有效期

長度相同之期間的每日歷史波幅作出。預期股息

乃按過往股息而定。用作計算的主觀假設如有更

改,可能重大影響公允價值的估計。

購股權是基於已提供服務的條件授出。計算所獲

提供服務於授出日期之公允價值時,並無考慮該

項條件。授出購股權與市況無關。