貿易通電子貿易有限公司

二零一七年中期報告

47

Notes to the Unaudited Interim Financial Report

(Continued)

未經審核中期財務報告附註

(續)

15

其他財務資產(續)

(ii)

分類為第三級的企業債券

用於第三級公允價值計量的估值方法及輸入數據

截至二零一七年六月三十日止六個月,本集團一

項企業債券由第一級轉入第三級。此乃由於企業

債券發行人出現財務困難,而有關債券已於期內

暫停買賣。失去活躍市場指釐定公允價值時已使

用重大不可觀察價格資料及判斷。本集團倚賴一

名經紀的指示性報價釐定公允價值,並認為有關

價值具代表性,原因為有關價值與報告日期前後

的場外交易價格相近。

除上述者外,第一級及第二級之間並無其他轉

換,亦無自第三級轉入或轉出(二零一六年:

無)。本集團的政策為於報告期末確認公允價值等

級之間的轉換,即導致轉換被視作於報告期末已

發生的情況變動。

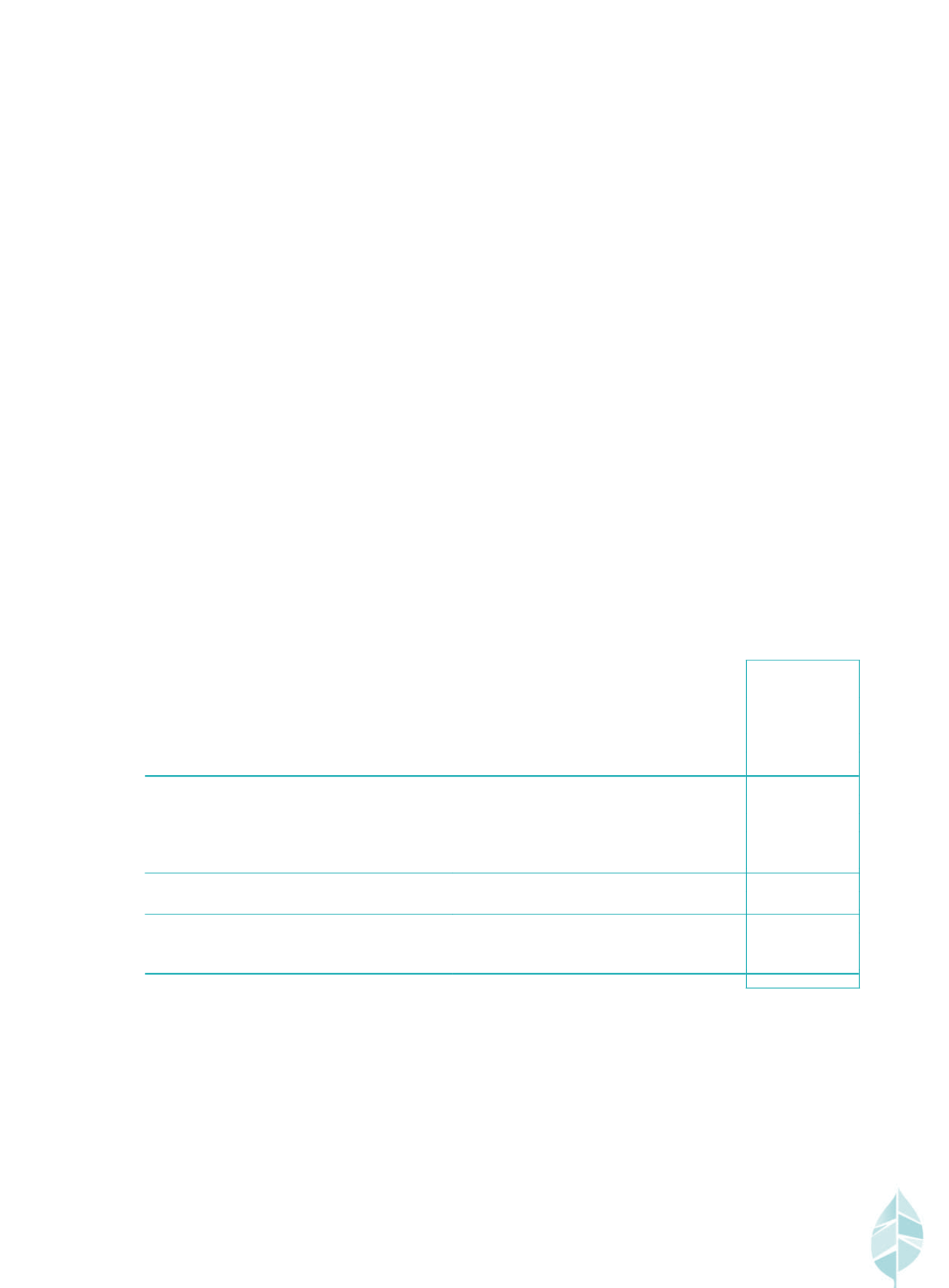

期內有關第三級公允價值計量結餘的變動如下:

15 Other financial assets (continued)

(ii) Corporate bonds categorised in level 3

Valuation technique and inputs used in Level 3 fair value

measurements

During the six months ended 30 June 2017, the Group transferred a

corporate bond from Level 1 into Level 3. This is because the issuer of

the corporate bond encountered financial difficulties and the bond has

been suspended from trading during the period. The disappearance

of an active market meant that significant unobservable price

information and judgement were used in the determination of fair

value. The Group relied upon a broker indicative quote to determine

the fair value and considered it representative because the value was

similar to a price transacted over-the-counter near the reporting date.

Except for the abovementioned, there were no other transfers between

Level 1 and Level 2, or transfers into or out of Level 3 (2016: Nil).

The Group’s policy is to recognise transfers between levels of fair

value hierarchy as at the end of the reporting period, i.e. change in

circumstances that cause the transfer deemed to have occurred at the

end of the reporting period.

The movements during the period in the balance of these Level 3 fair

value measurements are as follows:

As at

30 June 2017

於二零一七年

六月三十日

HK$’000

港幣千元

Opening balance

期初結餘

–

Transfer into Level 3 on 30 June 2017*

於二零一七年六月三十日轉入第三級

*

16,117

Impairment loss recognised in profit or loss on

30 June 2017*

於二零一七年六月三十日在損益確認的減值虧損

*

(7,992)

Closing balance

期末結餘

8,125

Total losses for the period included in profit or loss for

the assets held at the end of the period

於期末所持資產計入損益的期內虧損總額

7,992

*

Change in circumstances caused the transfer is deemed to occur at the end of

the reporting period, i.e. 30 June 2017 and impairment loss is recognised on

the same date.

Impairment of other financial assets

At 30 June 2017, the Group considered impairment indications existed for

an available-for-sale debt security and carried out an impairment assessment

for that available-for-sale debt security. Based on management’s assessment,

an impairment loss of HK$7,992,000 has been recognised in the profit or

loss being the difference between the acquisition cost (net of amortisation)

and fair value at 30 June 2017.

*

導致轉換的情況變動被視作於報告期末(即二零一七年

六月三十日)發生,而減值虧損於同日確認。

其他財務資產減值

於二零一七年六月三十日,本集團認為一項可供出售

債務證券存在減值跡象,並對有關可供出售債務證券

進行減值評估。根據管理層所作評估,已於損益確認

減值虧損港幣

7,992,000

元,即收購成本(扣除攤銷)

與於二零一七年六月三十日公允價值的差額。