Tradelink Electronic Commerce Limited

貿易通電子貿易有限公司

110

Notes to the Financial Statements

財務報表附註

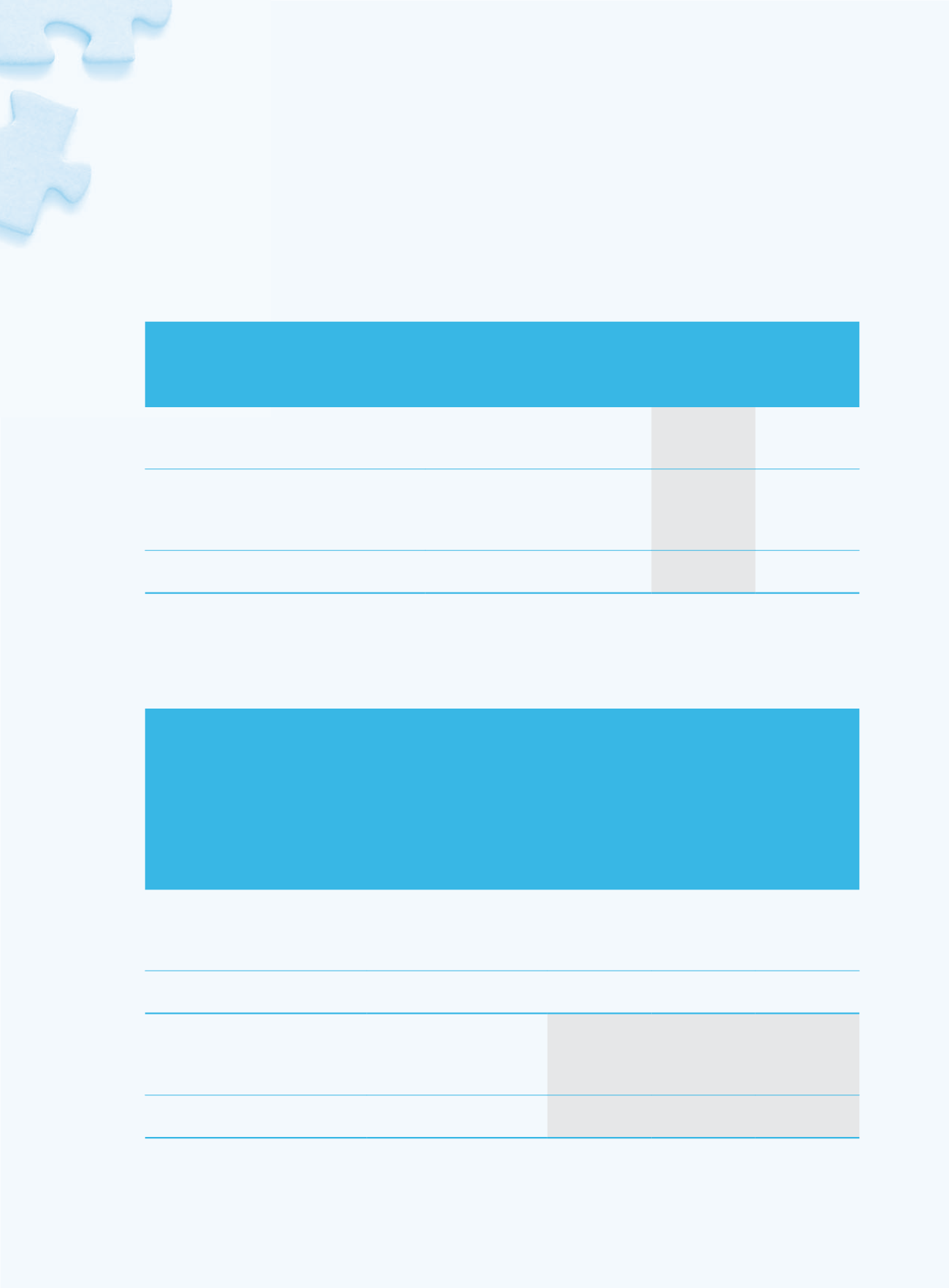

8 Income tax in the consolidated statement of

financial position

(a) Current taxation in the consolidated statement of

financial position represents:

2016

2015

二零一六年

二零一五年

HK$’000

HK$’000

港幣千元

港幣千元

Provision for Hong Kong Profits Tax for the year

本年度香港利得稅撥備

11,171

10,862

Provisional Profits Tax paid

已付暫繳利得稅

(8,162)

(10,265)

3,009

597

Balance of PRC tax provision relating

to prior years

以往年度中國稅項撥備結餘

132

194

3,141

791

(b) Deferred tax assets and liabilities recognised:

The components of deferred tax assets/(liabilities) recognised in the

consolidated statement of financial position and the movements

during the year are as follows:

Deferred tax arising from:

Depreciation

allowances

in excess of

related

depreciation

Tax losses

Total

來自下列各項的遞延稅項:

折舊抵免超出

相關折舊 稅項虧損

總計

HK$’000

HK$’000

HK$’000

港幣千元 港幣千元 港幣千元

As at 1 January 2015

於二零一五年一月一日

(415)

–

(415)

Charged to profit or loss

於損益表扣除

(100)

–

(100)

As at 31 December 2015

於二零一五年十二月三十一日

(515)

–

(515)

As at 1 January 2016

於二零一六年一月一日

(515)

–

(515)

Credited to profit or loss

於損益表計入

101

8,920

9,021

As at 31 December 2016

於二零一六年十二月三十一日

(414)

8,920

8,506

8

綜合財務狀況表的所得稅

(a)

綜合財務狀況表的本期稅項為:

(b)

已確認的遞延稅項資產及負債:

已於綜合財務狀況表確認的遞延稅項資產╱(負

債)的組成部分及年內變動如下: